Considering machinery values are increasing, farm equipment is becoming more important, and producers need to stay competitive. One way is through adopting new technologies.

In 2016, strength in farm cash receipts may help drive equipment purchases, while a weaker Canadian dollar raises the costs of new farm equipment.

Farm equipment by province

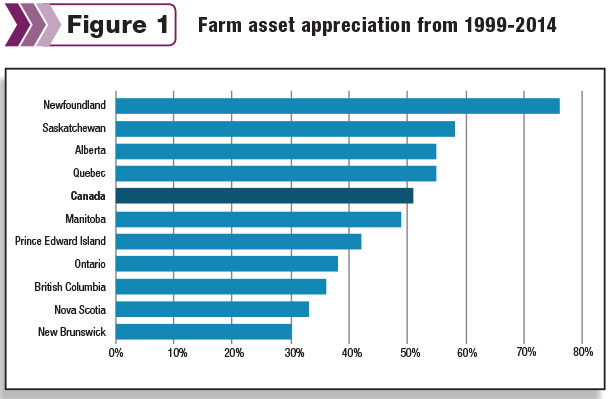

The Prairie provinces (Saskatchewan, Alberta and Manitoba) represent more than 80 percent of Canadian farmland and therefore have a large influence on national trends. Since 1999, the value of machinery has appreciated by 58 percent in Saskatchewan, 55 percent in Alberta and 49 percent in Manitoba.

The Maritime provinces (Nova Scotia, New Brunswick and Prince Edward Island) have a lower level of appreciation in machinery asset values at 34 percent.

Expansion or upgrades in equipment are not happening as fast in these provinces. Newfoundland and Labrador had the highest level of machinery appreciation from 1999 to 2014 in Canada at 76 percent.

However, this data must be interpreted with caution as climate and terrain features may partly explain the trend compared to other regions. Quebec, Ontario and British Columbia had machinery appreciation of 55 percent, 38 percent and 36 percent, respectively.

Farm equipment values increase but represent a declining percentage of total farm assets

Increasing land values dominate the balance sheets of producers. In the latest FCC farmland values report, farmland values increased 10.1 percent in Canada in 2015. Farm equipment has gone from representing 15 percent of total farm asset values in 1999 to 8 percent of farm assets in 2014.

In the same time period, the proportion of assets held in machinery in Ontario and British Columbia has halved from 10 percent to 5 percent, giving these two provinces the lowest proportion of machinery assets.

New Brunswick and Saskatchewan have the highest amount of machinery assets for 2014 at 13 percent. To learn more about the farm equipment market, read our recent farm equipment sales report. PD

By sharing agriculture economic knowledge and forecasts, FCC provides solid insights and expertise to help those in the business of agriculture achieve their goals.

For further agriculture economic insights and analysis, read the latest FCC Ag Economist blog post online.

-

Jean-Philippe Gervais

- Chief Agricultural Economist

- Farm Credit Canada