“There are several reasons to approach the future with caution and with an expectation that opportunities for growth and for profit will be more limited than during the last 20 years,” Jack Rodenburg stated.

During his presentation on “Managing your dairy with narrower profit margins” at the 2019 South Western Ontario Dairy Symposium in March in Woodstock, Ontario, Rodenburg explained it’s a complicated topic with a lot of opinions on how to handle it.

As a consultant with DairyLogix Consulting, Rodenburg shared his viewpoint on the current state of the industry, its impact for dairy producers and cost-saving strategies that could be implemented for a more profitable future.

The trade deal effect

Rodenburg said the first impact from recent import trade deals will be felt in 2019. He expects imports to increase quickly over six years and then slower from 2025 to 2032, yet the extent is unclear due to the unpredictability of domestic market growth.

He explained, “To date, these deals have really not affected you at all yet. The recent downturn in market growth is probably based on adjustments with Canadian demand … You’re going to start feeling it this year, and it’s going to get worse from every year from 2020 through to 2025, which will be the toughest years in terms of how the industry will change.”

Rodenburg advised dairy producers look to industry leaders to find out how these deals will impact the farm level.

“You have industry leaders, and that should be very clear by now on what the implications of this are going to be. They’re the ones who need to give you the answers so you can manage strategically,” he said.

Dairy Farmers of Canada (DFC) reported close to 20 percent of Canadian dairy consumption will be imported by the time the full effect of all three deals are in place.

Rodenburg estimated the Comprehensive Economic Trade Agreement (CETA) will take 2 percent, Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) 4 percent, and Canada-U.S.-Mexico Agreement (CUSMA) 4 percent or more, depending on how surplus solids non-fat (SNF) are sold.

Factoring in consumer demand at 2 to 3 percent due to population growth, he suggested it should balance out; however, he predicted dairy to be losing ground with consumers (changes in the food guide, sugar content in milk, etc.).

“The biggest impact on you will be little growth rather than significantly lower prices,” he said. He doesn’t expect quota to increase and figured there will be fewer incentive days.

This is a significant change compared to the recent 5 percent increase in growth each year. At the same time, costs keep going up, which leads to a potential for lower margins.

Working with a narrow profit margin

In order to be profitable in this kind of marketplace, Rodenburg advised, “Essentially, you need to do more than less and do it in an environment where growth is going to be quite limited.”

To combat this challenge, he proposed four management strategies: Cutting costs, do what you’re already doing but better, stop doing unprofitable activities and seek new revenue opportunities outside of dairy.

1. Cut costs where you can

Know your costs and margins in every area of your business. “Your financial record-keeping and financial analysis of those records are going to be more important than ever,” Rodenburg stated. Identify and eliminate what you spend on nonessential services but choose carefully, he added.

Base decisions on cash-flow projections and take advantage of economies of scale – like using the saved time from the efficiencies of new equipment to do custom work. Avoid cutting important data-collecting services because “Benchmarking is your main tool for analysing your business,” he said.

Being able to compare strengths and weaknesses to other dairy farms is a well-established way to monitor and identify areas of improvement as well as measure your profitability within the industry.

2. Do what you do better

Fix the weakest link and pick the low-hanging fruit, Rodenburg recommended. An annual study by Agstar Financial and Zoetis in the U.S. Northeast measured and analysed 90 different production variables to identify six factors that account for 85 percent of the variation of profit:

- Lower somatic cell counts (SCC) (196,000 versus 239,000)

- Higher energy-corrected milk per cow

- Lower death losses

- Lower net herd replacement costs

- Higher pregnancy rates

- Higher heifer survival (95 percent versus 93 percent)

The study showed there is a higher profitability associated with milking older cows.

“Consistent in high-production herds is that they milk more older cows. Older cows give more milk than heifers of the same quality. So if you can manage your herd so you have more older cows, I think you’re going to make more money,” Rodenburg said. He also suggested dairy producers consult with advisers to improve in these areas.

Another factor to consider is feed, which is one of the biggest expenses on a farm. Rodenburg advised producers to focus on quality, harvest on time and quickly, avoid weather damage and pack, cover and keep a clean face.

“What surprises me is that we tend to put all this emphasis on the forage side, on the alfalfa and grass side, but with my experience the more profitable herds all feed substantial amounts of corn silage,” he said.

Feed should have more than 50 percent corn silage, and it needs to ferment for at least two months before feeding to increase starch digestibility, which reduces the risk of rumen acidosis and increases the value of the feed. An error Rodenburg often sees is letting cows clean up the feed manger.

“This gives a false sense of economy,” he said. “A dairy cow is well fed if there is 5 percent left over. Take that 5 percent and stick it back into the TMR mixer, weigh it and monitor it, feed to heifers … it’s the only way to know that you’re maximizing their intake.” Herds that do this see 3 to 5 litres more milk as a result.

3. Stop doing unprofitable things

Look at things that are unprofitable on the farm. One example is: Raising too many replacement heifers. Looking at data from the 2010 Ontario Dairy Farm Accounting Project (ODFAP) and adjusting it to today’s costs (42 percent increase), Rodenburg calculated the cost of raising a Holstein heifer today to be $3,010 to break even.

“I think we can all assume we’re losing money on these heifers. I’m going to suggest you stop doing this. You need to calculate how many heifers you need to replace culled cows, breed your best cows to top A.I. sires to produce that number of heifers and then breed the rest to beef sires; that will double or triple the value of those calves sold at 2 weeks [old],” he said.

With expansion opportunities close to zero for the next six to 10 years, not selling your heifers at a loss is a way to improve the bottom line.

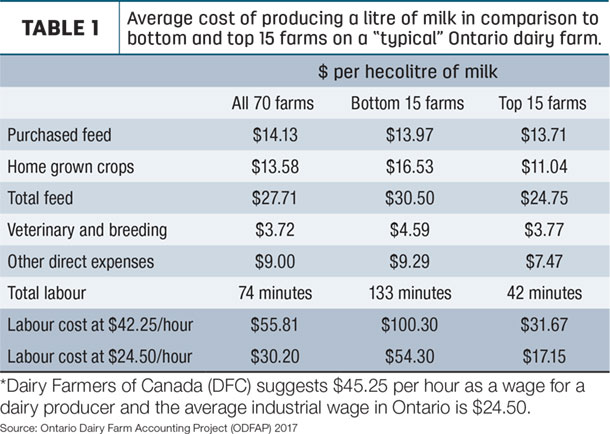

Rodenburg also pointed out labour is the most variable input cost on the farm. According to the ODFAP, the average dairy producer takes 74 minutes to produce a hectolitre of milk (Table 1).

Comparing labour per hectolitre by herd size and production system, the 2017 ODFAP found bigger herds need less labour per hectolitre, and freestall herds need less than tiestalls.

Automation and robotics can help gain labour efficiencies and improve lifestyle. Rodenburg calculated the cost to milk with a $200,000 robot in a large herd at 56 cents per milking.

He stressed the importance of capitalizing on labour-saving opportunities because labour savings only improve profits if the labour saved is applied to other profitable pursuits.

4. Find new revenue sources outside of dairy

Starting a new business or differentiating in the marketplace is another strategy for the future. Rodenburg pointed out trending niche markets: A2 milk, organic premium milk and food tourism.

“I think food tourism is something as an industry we need to put a focus on … 20 years ago, milk was ‘nature’s perfect food,’ and today you can’t get it into schools because it is ‘too high in sugar’.

The situation has changed dramatically, and we’ve got to win the consumer back,” he said. Having well-managed farms close to city centres and open for business can only help build the image of dairy production while educating consumers where their food comes from.

As the effects of the trade deals are starting to show in the market, now is a good time to strategically plan and implement cost-saving strategies on the farm for a more profitable future. ![]()

Visit South Western Ontario Dairy Symposium to read the proceedings.

-

Lora Bender

- Editor

- Progressive Dairyman

- Email Lora Bender