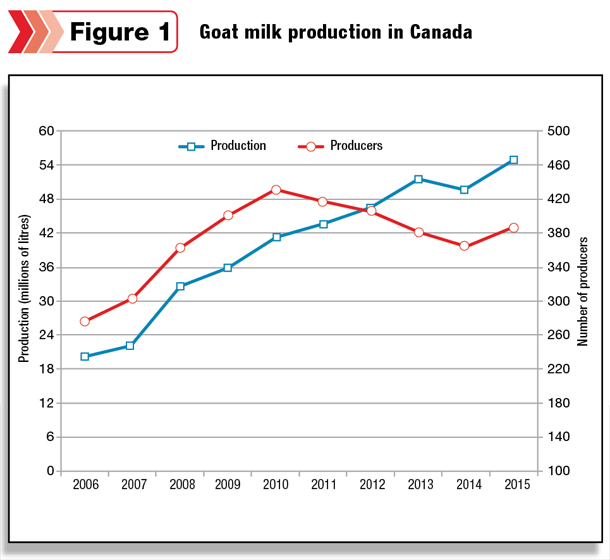

“We’ve seen a lot of growth in the industry over the past few years. A lot of people are looking at the goat industry in our agriculture industry as the next sector,” Jennifer Haley said. Haley, the executive director of Ontario Goat, spoke about the growing industry during the 2016 Canadian Dairy XPO (CDX) in Stratford, Ontario.

Governed by a board of nine producers, Ontario Goat is the commodity organization representing the goat industry, including meat, milk and fibre producers.

It operates with a voluntary checkoff of $0.005 per litre of goat milk shipped by the producer members at their own choosing. More than half (52 percent) of all goats in Canada reside in Ontario. The province is home to 36 percent of the country’s goat farms.

Dairy goat farms in Ontario consist of 32 hand-milking operations, 25 bucket-milking operations, 182 pipeline operations and three rotary parlours. The largest herd in the province has 1,600 milking does, milked three times a day.

“There’s a lot of excitement and optimism for future growth. When you talk to people in the industry – whether it’s government, service providers, industry people – it really seems Ontario is becoming the epicentre for processing, production, research, technology, anything to do with the dairy goat sector,” Haley said.

Compared to other provinces, Ontario dairy goat farmers produce a lot more milk on a per-farm basis, she said. Last year, the goats produced approximately 42 million litres or about 85 percent of the goat milk produced in Canada.

The bulk of the milk – about 90 percent – is used for cheese production. The other 10 percent is used for fluid milk and other dairy products.

According to Haley, cow and goat milk have similar nutrient compositions; however, goat milk is higher in protein and energy, along with several vitamins and minerals. Some people find goat milk is a little easier to digest due to its smaller fat globules, she added.

“Many people that have a lactose intolerance do tend to tolerate goat milk,” she said.

Goats produce about 10 percent of what a cow can make on a daily basis. A good goat will average 3 litres a day. The average production components, like fat and protein, vary between breeds. The most common dairy goat breeds are Saanen, Alpine, Toggenburg, Nubian and LaManca.

Saanens are the most popular dairy goat breed, making up 80 percent of dairy goats in Ontario. Saanens are known for their high milk yields and calm nature. There’s no quota involved in the goat industry, but like dairy cow producers, goat farms must be licensed to ship milk.

More and more farms are starting or expanding each year to meet the growing demand. “The real demand right now is for goat cheese,” Haley said. Someone who is very familiar with the need for more goat cheese is Bruce Vandenberg, president of Mariposa Dairy Ltd.

Vandenberg and his wife, Sharon, own and operate Mariposa Dairy Ltd. in Ontario. They started in 1989 with 130 goats and an 800-square-foot cheese plant.

After years of expansion, the farm now has 1,200 goats and is the second-largest goat cheese manufacturer in Canada. Their products are available in every Canadian province and U.S. state.

The growth hasn’t been easy. “Over the last 20 years, there’s been a couple of hiccups,” Vandenberg explained while speaking at CDX.

In 2002, there was more goat milk produced than what the processors could handle and the market could bear, so there was a retraction in the industry. It happened again in 2008.

Vandenberg said the industry has learned from those moments and opened up communication along the supply chain to prevent history from repeating itself. Of the 42 million litres of goat milk produced in Ontario, half is consumed in Canada and the remaining half is exported to the U.S.

“The U.S. basically produces the same amount as we do,” he said. “The U.S. is not a big goat milk producer.”

However, that may be changing, as there are some big dairies in the U.S. looking to diversify. This spring one dairy was in the news for its intention to build a 7,500-goat operation in Wisconsin. Vandenberg and other Canadian producers are looking to capitalize on the growing demand.

“The U.S. is a huge market wanting our product. There is very large growth potential in the U.S.,” he said, noting most of that growth is coming from the restaurant industry.

European companies looking to capitalize on U.S. demand are buying cheese plants there. They are shipping in frozen curd, repackaging and selling it, Vandenberg said, adding, “The market is taking it because the market needs it.”

In the last two to three years, Europe has pulled back from exporting as much curd as previously done. Instead it is busy building milk drying facilities.

“The milk that would normally go into curd that would be exported isn’t as readily available. It’s being turned into powder and shipped to China – and that market is growing,” Vandenberg said.

He noted Canada is positioned to take advantage of this growing demand with the dairy goat infrastructure it is building. “In a few years, when figured out, we have opportunities to ship to Europe … we have the potential to be a player in the world,” Vandenberg said.

Haley commented that the industry is looking for controlled and sustainable growth. Conservative projections show a 5 to 10 percent growth in the next five years. Achieving more growth will not happen without overcoming a few challenges.

There are a lot of young producers in the industry, which means there is not a lot of generational knowledge transfer as seen in other areas of agriculture.

“A lot of people are starting from scratch with their businesses. There’s a lot of need for education and research,” Haley said.

Having a young industry also means there are a lot of farms needing to service debt, raising their cost of production. A survey of 14 sample farms in 2014 had the top five farms showing a cost of production of $0.96 a litre. Haley said the average price of goat milk at the farm is about $1 to $1.50 a litre.

The industry is also looking to eradicate scrapie disease, a fatal, degenerative disease affecting the central nervous system of sheep and goats.

Ontario Goat is participating in a joint project to look at genotyping the scrapie-resistant gene and develop breeding strategies to breed the scrapie disease out of the Ontario herd. “There’s currently no vaccine or treatment available right now,” Haley said.

Despite the challenges, there is an excitement amongst dairy goat producers in Ontario to continue to grow and meet the demands of the marketplace. PD